what is the inheritance tax rate in virginia

Unlike the federal estate tax where the estate pays the taxes inheritance taxes are the responsibility of the beneficiary of the property. Virginia estate tax.

Estate And Inheritance Taxes By State In 2021 The Motley Fool

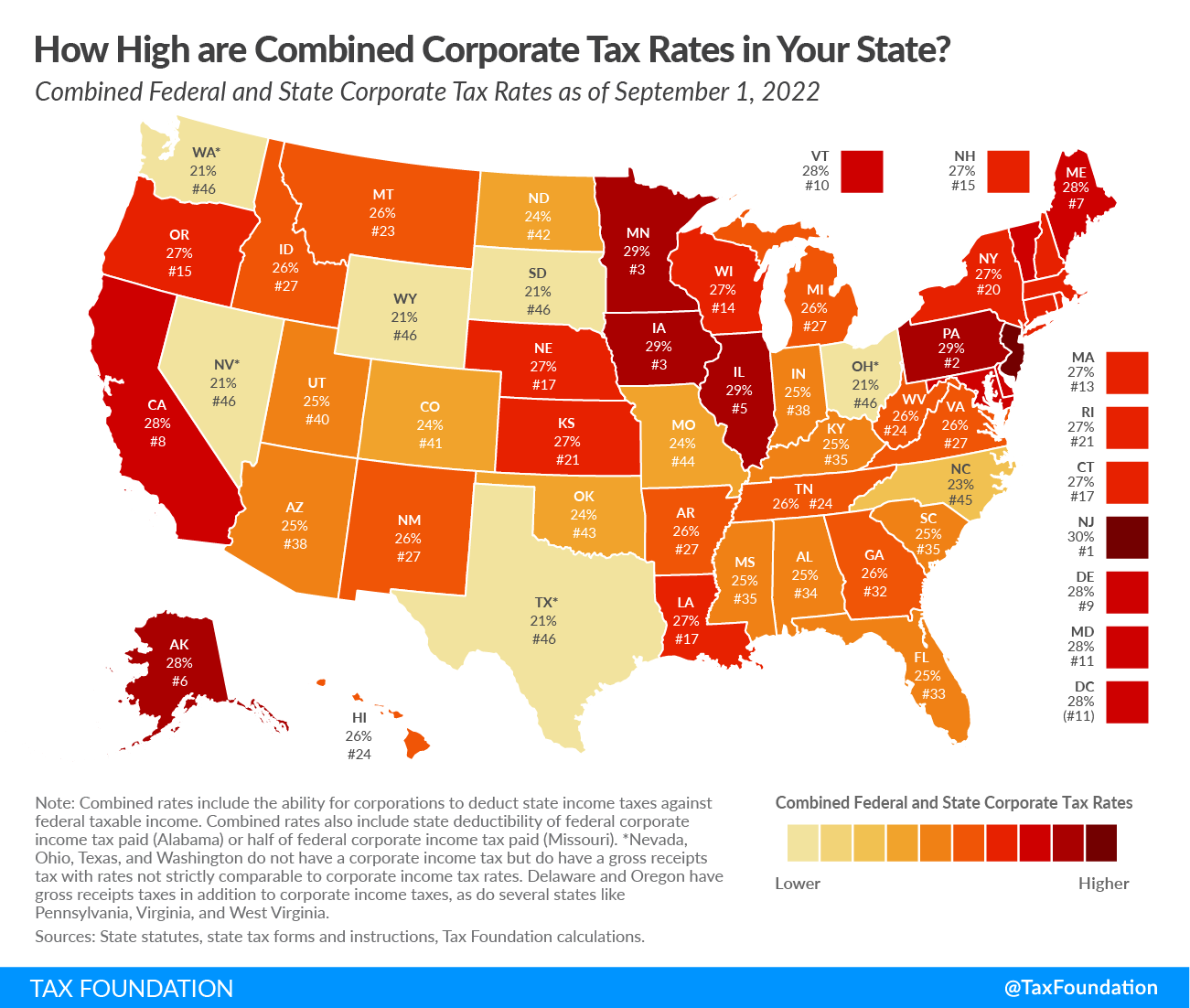

The estate tax is a tax on a persons assets after death.

. The estate tax is a tax on a persons assets after death. See 1978 House Bill 442 1978 Acts of Assembly Chapter 838 and Va. How is personal property tax calculated on a car in virginia.

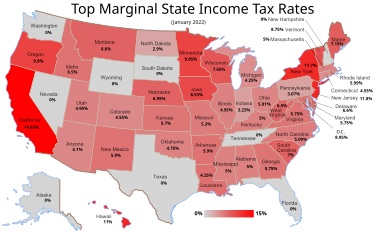

Code 581-900 through 581-938. Virginia doesnt have an inheritance or estate tax. The sales tax rate for most locations in Virginia is 53.

Several areas have an. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023 and the estate tax rate ranges from 18 to 40.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Virginia taxes capital gains at the same income tax rate up to 575. How much can you inherit without paying taxes in Virginia.

The estate tax was imposed on the transfer of a taxable estate at a. How much is federal tax on inheritance. Unlike the federal government Virginia does not have an estate tax.

To look up a rate for a specific address or in a specific city or county in Virginia use our sales tax rate lookup. State inheritance tax rates range from 1 up to 16. How much is federal tax on inheritance.

21 hours agoOffice of Tax Simplification said aligning CGT with income tax could raise 14bn Currently higher rate taxpayers pay 20 on stocks and 28 on second homes Now the. That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in. A tax in an amount computed as provided in this section is imposed on the transfer of every nonresidents taxable estate located in the Commonwealth of Virginia.

12 percent on transfers to siblings. How much can you inherit without paying taxes in Virginia. But just because Virginia does not have an.

The tax shall be an. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax.

This is great news for Virginia residents.

Estate Tax Calculator Washington Dc Maryland Virginia Lawyer Attorney Law Firm

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

State Tax Levels In The United States Wikipedia

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Federal Estate And Missouri Inheritance Taxes Legacy Law Missouri

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Virginia Tax Payment Amendments Virginia Business Tax

Virginia Inheritance Laws What You Should Know Smartasset

:max_bytes(150000):strip_icc()/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Estate Tax Current Law 2026 Biden Tax Proposal

Virginia Sales Tax Holiday Virginia Tax

Estate Taxes They Re Not Dead Yet C Douglas Welty Plc

Cotton Boozman Blunt And Ernst Introduce Estate Tax Rate Reduction