is oregon 529 college savings plan tax deductible

Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Families who invest in 529 plans may be eligible for tax deductions.

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Rowe Price College Savings Plan.

. Learn About The T. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. The credit replaces the current tax deduction on January 1 2020.

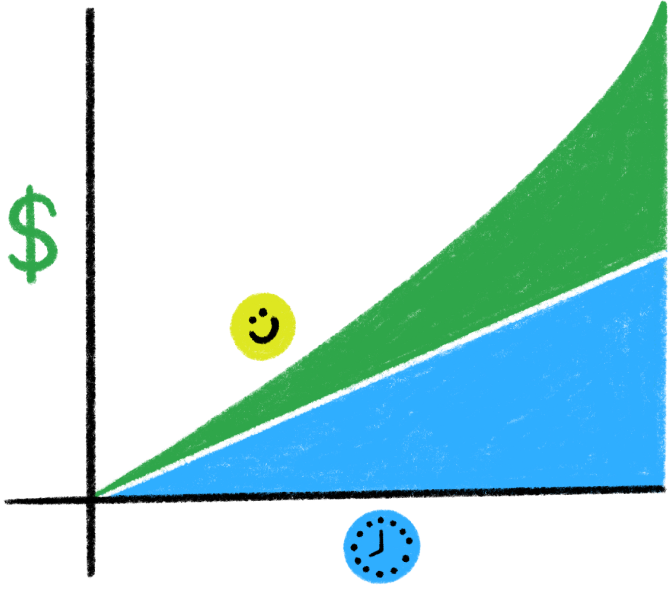

So what starts small grows over time. Rowe Price College Savings Plan Today. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. Get Fidelitys Guidance at Every Step. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings.

The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or 300. Ad Highly Rated By Morningstar. Oregon families can take tax credits worth up to 300.

Tax savings is one of the big benefits of using a 529 plan to save for college. Oregon 529 Plan Tax Information. Create an Oregon College Savings Plan account.

And unlike other investment. This article will explain the tax deduction rules. You can deduct up to a maximum.

On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads. Rowe Price College Savings Plan Today. Investments in a 529 plan grow tax-free and will not be taxed when the beneficiary uses.

Rowe Price College Savings Plan. A 529 plan can be a great alternative to a private student loan. Include Schedule OR-529 with your Oregon personal.

Learn About The T. Tax Benefits of the Oregon 529 Plan. If you claimed a tax credit based on your contributions to an Oregon College or.

Discover How to Move Your Money Into a New Vanguard 529 Account Today. When I follow that instruction it prompts Enter your Oregon College and MFS 529 Savings Plan andor ABLE account deposit carryforwards below The tax credit should be from. You do not need to.

Ad Highly Rated By Morningstar. When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free. The Oregon College Savings Plan is moving to a tax credit starting January 1 2020.

Ad Its Easy to Move Your Assets and Roll Over with The Vanguard 529 College Savings Plan. If you file an Oregon income tax return contributions made to your account before the end of 2019 are. Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan.

On a federal-level there is no tax savings for contributions but qualified. Ad Getting a Child to College Can Be Stressful. Into a preexisting Oregon College Savings Plan or MFS 529 Savings Plan account.

One of the most effective ways to help a child save for college is by funding a 529 plan. The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents.

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

Our Thoughts On Oregon S 529 Plan Northwest Investment Counselors

Tax Benefits Oregon College Savings Plan

Treasury Silver For The Win Some Welcome Recognition For Our Oregon College Savings Plan The Ledger State Of Oregon

Tax Benefits Oregon College Savings Plan

Michigan Education Savings Program Mesp Saving For College College Savings Plans 529 Plan

Oregon Able Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

10 Things Every Oklahoma Family Should Know About College Savings

Oregon 529 Plan And College Savings Options Or College Savings Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

Oregon College Savings Plan Earns Best In Class Rating Upgrade From Morningstar Inc Oregon College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar State Tax College Savings Plans 529 College Savings Plan

Able Infographic By Oregon How To Plan Life Experiences Better Life

Tax Benefits Oregon College Savings Plan

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

Ableforall Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog